Year-end Process: Close the Financial Year

- 3 minute read

- Finance and Accounting, Legal and Corporate Law

When the financial year is coming to an end, the main deadline to keep in mind is that the annual report must be filed no later than 6 months after the financial year-end. And you may think that a 6-month year-end process is plenty of time to prepare everything and meet all the requirements for compliance.

However, preparing a sufficient final annual report and tax return can be a rather long and complicated process. And the process will rarely be the same two years in a row – unfortunately! Because there are many aspects to consider and act on, both from financial and legal perspectives.

Let’s unpack it!

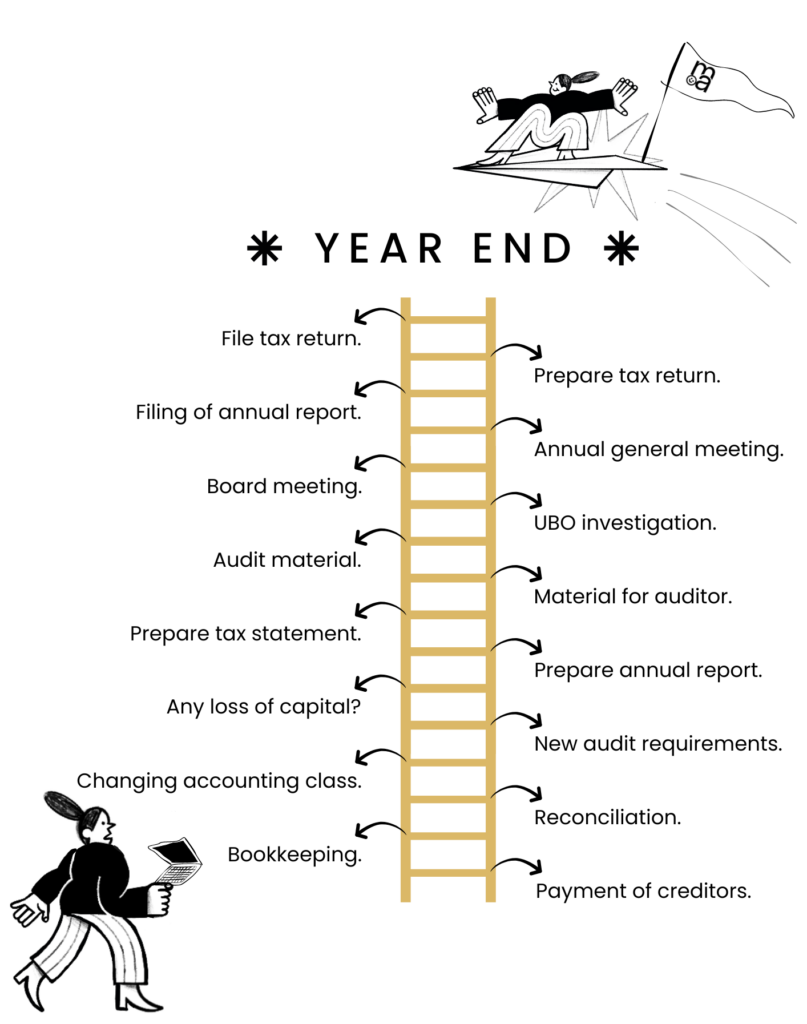

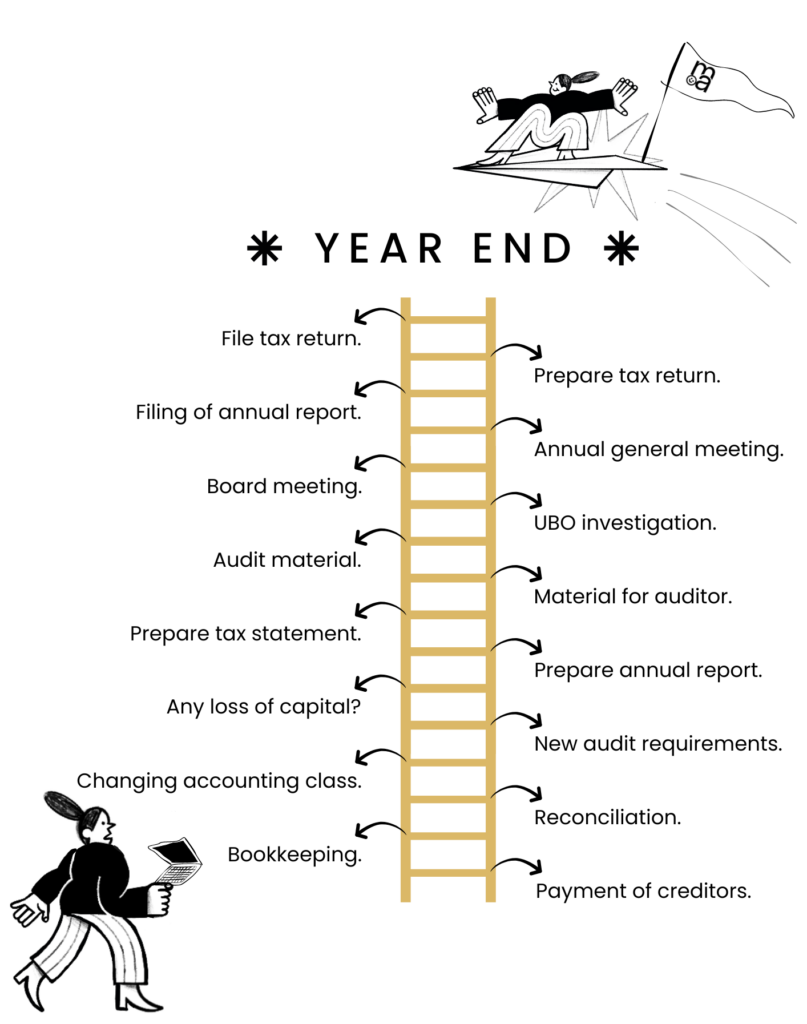

Step 1: Closing the books of the financial year.

Depending on your business, you might be closing books on a monthly, quarterly, or even annual basis. But whichever frequency fits your business, you must do a thorough completion of all relevant steps at the end of any accounting period.

Closing the books of the financial year is a time-consuming and complicated project in itself. But during the process it is important to ask the following: Are all payments of invoices related to the financial year to be closed? Is all bookkeeping up to date? Has a reconciliation been made?

Once the closing of the books is completed, and the final draft of the balance and P&L is prepared, you will now need to prepare the annual report and tax statement.

When doing so, you also need to assess the following:

Are there any changes to the accounting class the company falls within (Regnskabsklasse)?

Are there any changes to regulations or audit requirements that you need to take into account?

Has the business experienced any loss of capital or thin capitalization that you need to account for?

At mighty admins, we can assist you with the entire process from closing the books to the big-picture stuff.

Step 2: Preparation of audit

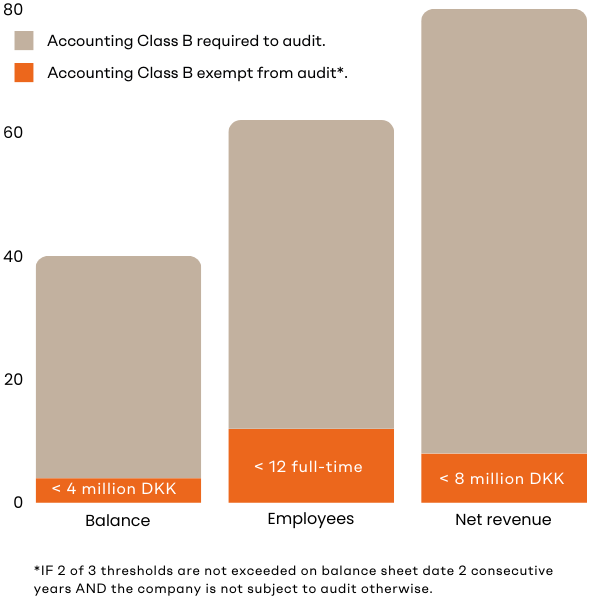

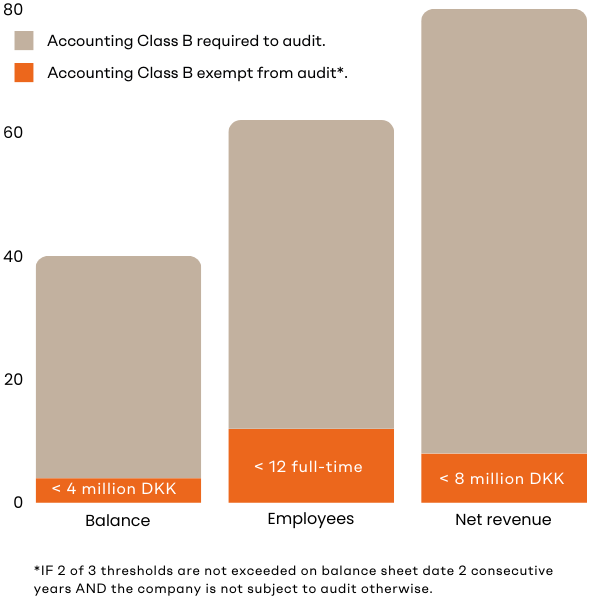

Next up, you must start preparing for audit. As a rule of thumb, all companies in Denmark are subject to be audited. However, certain small companies can be exempt from audit. In broad terms, this is valid for small companies that in the last 2 consecutive financial years do not exceed 2 of 3 of the following on balance sheet date:

A balance of 4 million DKK.

A net revenue of 8 million DKK.

An average of 12 full-time employees during the financial year.

However, should the company exceed a balance of 50 million DKK, it is not exempt from audit – despite not exceeding the 2 other thresholds. Make sure to go through everything with your accountant well in time.

Furthermore, companies in Accounting Class B operating within certain high-risk industries are never exempt, if they in 2 consecutive years at the balance sheet date exceed a net revenue of 5 million DKK.

If a company needs to be audited, the material for the auditor must be collected diligently. And besides all the accounting material, the auditor also needs legal material such as board meeting minutes, general meeting minutes, loan agreements, lease agreements, and much more relevant supplementary material.

Step 3: Board meeting and UBO investigation

While preparing the annual report, you must also start preparing the board meeting set to approve this annual report.

At this board meeting, the annual report (and if required; the auditor’s report), the tax statement, and a UBO investigation must be presented and approved by the board.

In 2017, requirements for UBO investigations were added to the Danish Companies Act. This means that many of the companies required to file an annual report in Denmark must also identify the Ultimate Beneficial Owner (UBO). Doing so helps to ensure that the information registered with the Danish Business Authorities is correct.

After being presented and approved, the investigation must be stored for 5 years.

Step 4: The Annual General Meeting

The step after the board meeting approving the annual report is to conduct the annual general meeting. This is where the shareholders of the company are informed about the passing financial year. Here is what must be included on the agenda:

Management must provide a review of the financial year.

The shareholders must approve the annual report.

The board is selected and if required, an auditor is elected.

Once the Annual General meeting is over, the annual report must be filed with the Danish Business Authorities – and it must be filed as a special XBRL file.

At mighty admins, we can help you stay compliant with the evolving regulations as well as assist you in facilitating these mandatory steps in the year-end process.

Step 5: Filing tax returns

Now we’re getting there! Just a few (but rather complicated) steps left. The main one is filing tax returns with the Danish Tax Agency. Make sure to consult an expert who can help you with everything from your tax statement to filing your tax return to avoid penalties and fines.

For many, filing tax returns would have been the last step in the year-end process. But in some cases, companies are required to file Transfer Pricing documentation with the Danish Tax Agency as well. More about that below!

At mighty admins, we can assist you with:

Bookkeeping.

Reconciliation.

Preparation and filing of annual report.

Tax statement.

Preparation of UBO investigation.

UBO documentation.

Board meeting facilitation and minutes.

Preparation and filing of tax return.

Annual general meeting facilitation and minutes.

… And much more!